First-Time Home Buyer Guide — Bedford, NH

Buying your first home is a major milestone, and if you’re considering Bedford, NH, you’re looking in one of Southern New Hampshire’s most desirable communities. From excellent schools to quiet neighborhoods and convenient access to Manchester and major highways, Bedford offers an ideal setting for first-time buyers.

At Costa Living, we specialize in providing Bedford home buying help for first-time buyers — guiding you through the process with clarity, confidence, and local expertise.

Is Bedford, NH a Good Place for First-Time Home Buyers?

Bedford is known for its strong community, long-term property value, and high quality of life. While home prices can be higher than some surrounding towns, many first time home buyers in Bedford NH choose the area for its stability and resale potential.

Benefits of buying in Bedford include:

-

Well-maintained neighborhoods and diverse housing options

-

Highly regarded public schools

-

Proximity to Manchester, Nashua, and Boston

-

Strong long-term home value trends

Understanding the market upfront helps first-time buyers make informed decisions.

Step-by-Step Bedford Home Buying Help for First-Time Buyers

Buying your first home doesn’t have to be overwhelming. Here’s how we simplify the process.

Step 1: Get Pre-Approved

Before touring homes, it’s important to understand your budget. We help first-time buyers connect with trusted local lenders who can explain loan programs, down payments, and monthly costs.

Step 2: Understand the Bedford Market

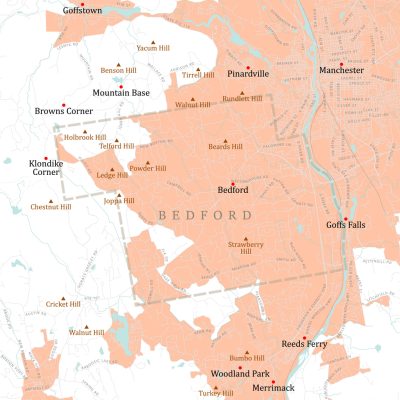

Bedford neighborhoods vary in pricing, home styles, and lot sizes. We explain what to expect in different areas so you know where your budget fits best.

Step 3: Find the Right Home

We help you identify homes that align with your lifestyle, future plans, and budget — not just what’s available online.

Step 4: Make a Competitive Offer

First-time buyers often worry about competing in a strong market. We guide you through writing a smart offer that protects your interests while remaining competitive.

Step 5: Inspections, Financing & Closing

From home inspections to final paperwork, we walk you through each step so you feel confident and informed all the way to closing day.

Common Mistakes First-Time Home Buyers Can Avoid

With the right guidance, many common first-time buyer mistakes can be avoided, including:

-

Skipping pre-approval before shopping

-

Overextending your budget

-

Ignoring future resale potential

-

Underestimating closing costs and ongoing expenses

Our role is to provide honest advice and help you make smart long-term decisions.

Why First-Time Buyers Choose Costa Living

First-time buyers need more than listings — they need education and advocacy. We provide personalized Bedford home buying help tailored to your goals.

When you work with Costa Living, you get:

-

Clear explanations at every stage of the process

-

Local Bedford market expertise

-

Guidance tailored specifically to first-time buyers

-

A trusted partner focused on your success

We’re here to help you feel confident, not rushed.

Ready to Buy Your First Home in Bedford, NH?

If you’re a first time home buyer in Bedford NH and want expert guidance from day one, Costa Living is here to help.

Contact us today to get personalized Bedford home buying help and start your journey toward homeownership.

Frequently Asked Questions for First-Time Home Buyers in Bedford, NH

What qualifies someone as a first-time home buyer in Bedford, NH?

Generally, you’re considered a first-time home buyer if you haven’t owned a home in the past three years. This may qualify you for certain loan programs or incentives, depending on lender guidelines.

Are there special loan programs for first-time home buyers in Bedford, NH?

Yes. Many first-time buyers qualify for programs such as FHA loans, conventional low down payment options, and state-backed assistance programs. A local lender can explain which options may work best for you.

How much money do I need to buy my first home in Bedford?

The amount needed depends on your loan type, down payment, and closing costs. While some programs allow lower down payments, it’s important to budget for inspections, escrow, and other upfront expenses.

Is Bedford too expensive for first-time buyers?

While Bedford prices are higher than some nearby towns, many first-time buyers choose Bedford for its long-term value, school system, and quality of life. We help buyers evaluate whether Bedford fits their budget and goals.

How long does the first-time home buying process take?

From pre-approval to closing, the process typically takes 30–60 days, depending on market conditions and financing.

Should I wait to buy or start looking now?

Timing depends on your financial readiness and personal goals. Speaking with a local expert early can help you understand the market and decide when the right time is for you.

Do I need a real estate agent as a first-time buyer?

Yes — especially as a first-time buyer. A local agent provides education, market insight, negotiation support, and helps protect your interests throughout the process.